Welcome to the Block & Mortar newsletter! Every week, I bring you the top stories and my analysis on where business meets web3: blockchain, cryptocurrencies, NFTs, and metaverse. Brought to you by Q McCallum.

Reading online? Subscribe to get this in your inbox whenever it's published.

The Bitcoin ETF wait is over

Last week I noted that 2023 was most certainly not the Year of the Bitcoin ETF. There were rumors, there were high hopes, there were (what some people took to be) signs, but it didn’t happen.

2024 has managed to upstage its predecessor right out of the gate: 10 January 2024, the SEC gave the green light to Bitcoin ETFs. Since Bitcoin’s first block – the Genesis Block – was mined 03 January 2009, I’ll call this a belated birthday gift from the regulator.

The chain of events

That gift came with a side of drama, though. It helps to think about markets and expectations.

Famed short-seller Jim Chanos notes that “opinions about facts are what set prices” in financial markets. The yearslong fact about Bitcoin ETFs had been “they haven’t been approved.” The growing opinion was: “but they soon will be.” That opinion drove Bitcoin prices up the last few weeks of 2023.

And then we have three key dates in early January:

Monday, 08 January ($46,995.10): SEC chair Gary Gensler posted a rather vague tweet thread about cryptocurrency. This was especially interesting as Gensler has not exactly been subtle about his feelings on crypto. (See his agency’s, um, shaky relationship with Coinbase.) Bitcoin enthusiasts took this as a sign of imminent approval.

Not to steal his thunder, but Gensler isn’t the only person in town whose tweets can move markets. Remember when That Guy tweeted about DogeCoin and its price jumped? Then again, at least no one suspects Gensler of drug use…

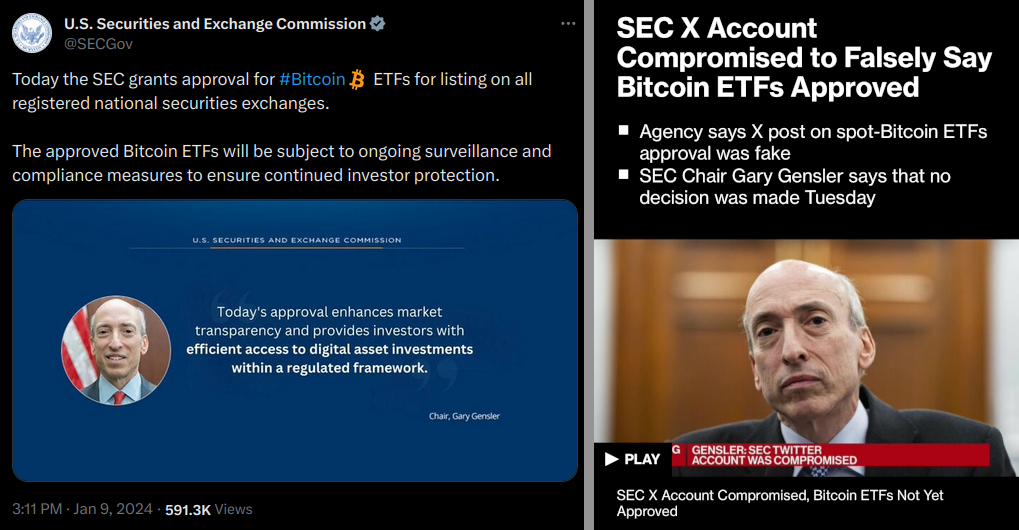

Tuesday, 09 January ($46,087.30): The SEC tweeted that the Bitcoin ETFs had been approved:

(Source: a tweet that has since been deleted.)

Well, let me reword that: someone tweeted from the SEC’s account that the Bitcoin ETFs had been approved. Who is that someone? It’s not clear. But the SEC claims it wasn’t them. They said that their account had been compromised and that the tweet was a fake.

It took some time for markets to absorb that correction, though. So prices at $46,000 based on the initial – fake – announcement.

(Before you laugh at the crypto markets for falling for this, let’s remember that tradfi beat them to it. Fake tweets shifted the stock market in 2013 and 2023. There were likely more such incidents; those are just the two I remembered off the top of my head.)

Wednesday, 10 January ($46,670.90): The SEC approved the Bitcoin ETFs. For real this time! They even posted the announcement to their own website. Bitcoin’s price rose yet again, to a peak of just below $46,700.

Going for the last word

SEC Chair Gary Gensler also issued his own statement shortly after the EFT approval. It’s an interesting read overall, though this bit certainly stands out:

Though we’re merit neutral, I’d note that the underlying assets in the metals [exchange-traded products, or ETPs] have consumer and industrial uses, while in contrast bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing.

This definitely reads like a sour Yelp review. All it needs is a “would not recommend” tacked on to the end.

Part of me thinks that Gensler is trying to maintain his anti-crypto street cred by distancing himself from the official agency position. And maybe it’s a hint that the Bitcoin ETF approval does not clear the path for future crypto products.

Much ado about something

With all the excitement, it’s easy to forget why the world wants a Bitcoin ETF to begin with?

Back in October I described the main benefit to investors:

Exchange-traded funds (ETFs) are an interesting layer of financial abstraction: they allow an investor to get exposure to some asset – that is, to be in the position to make or lose money as prices move – without having to buy it outright.

You can do cool things like define thematic ETFs which bundle a group of related stocks into a single, tradable unit. (Think “an ETF of gold mining companies” or “makers of AI gear.”) This also opens the door to trading assets that aren’t listed stocks. Like, say, Bitcoin. Can you imagine getting exposure to the ups and downs of Ye Olde $BTC without having to set up a crypto wallet? Or even know what a blockchain is?

(For the moment, we’ll try to not think about the ways Bitcoin exposure might indirectly wind up in your retirement portfolio. If you think that couldn’t possibly happen, some Canadian teachers would like a word.)

If you’re offering a Bitcoin ETF – you’ve purchased a pool of Bitcoin and you’d like to give investors fractional ownership thereof – then you’re in it for the money. At least, you should be. The major Bitcoin ETF providers have slashed their fees. Probably in some kind of market ploy for market dominance.

Then there’s the Bitcoin ecosystem as a whole. Even though Gensler is clearly not happy about this, the ETFs getting approval from a government regulator – a regulator that has claimed jurisdiction over many crypto projects and actively pursued participants – adds an air of legitimacy for the digital currencies.

Trading debt

Finance is all about seeing money through the lens of time. You buy a stock today on the expectation that its price will rise tomorrow (at which point you sell to gain a profit). You issue a loan today because you believe that the borrower will repay you the loan over the coming years (and your profit comes in the form of interest payments).

The general idea is that you are compensated for taking a risk and then winding up on the right side of the statistic.

Using that same formula, there’s also money to be made in unpaid debts. Or, at least, debts that appear unlikely to be repaid.

Let’s say a lender has issued a loan for $100,000 and the borrower has fallen far behind on payment.

-

The lender figures they’ll get at most $40k back of their original $100k-plus-interest.

-

You, on the other hand, have a hunch the borrower will repay at least $60k.

-

You pay the lender $50k for the debt. If you’re right, you’ve made $10k – a hefty twenty percent profit – for taking the risk and being right.

-

Even the lender wins out in this case, because they still get more than the $40k they were expecting.

Why am I explaining this? Because FTX owes creditors a lot of money. I mean, a lot. It’s in the billions. Yet it’s still not clear how the bankruptcy proceedings will turn out, and whether those creditors will get any of their money back. So there’s now a market for trading those debt claims.

The FTX case is not exactly the same as a traditional debt-collection scenario. The people purchasing that debt are not taking an active role in pursuing the debtors. They are placing a bet that the bankruptcy proceedings will turn out in their favor. But it’s a similar game in that they are trading places with a creditor, taking a more optimistic outlook on the debt’s odds of repayment.

This is ridiculous. Even for crypto.

You may have seen the name “Hyperverse” making its way through the news.

All you need to know about Hyperverse is that it’s unreal.

I mean, “unreal” in the sense that it’s looking like Yet Another Crypto Scam™. Sure.

Also in the sense that, um, the CEO doesn’t exist? The face belongs to a real person, but that was an actor paid to play a role. Authorities have picked up a guy who promoted Hyperverse but the actual leadership team remains at large.

This is just… weird. Even for crypto. I can’t wait to see how it develops.

And let this be a reminder that, once again, the header image from last weeks newsletter still applies:

The wrap-up

This was an issue of Block & Mortar.

Who’s behind Block & Mortar? I'm Q McCallum. I've spent the past two decades in the emerging-tech space. And I'm very interested in web3 use cases.

Credit where it's due. Big thanks to Shane Glynn for reviewing early drafts. Any mistakes that remain are mine.

Reading this online? Or as a forward? Why not sign up? Get Block & Mortar news in your inbox, whenever it's published.

Privacy statement: I don’t share/rent/sell your personal info. Seriously.